Several see stockholders' fairness as representing a company's Web belongings—its Internet value, so to talk, might be the quantity shareholders would receive if the corporate liquidated all of its assets and repaid all of its debts.

You’ll also take advantage of tax-free progress of what you invest, and your child won’t at any time owe taxes on the money given that it’s utilized for a qualified educational expenditure. Dependant upon your condition, you could possibly even get a split on the condition income taxes when you invest making use of its program.

With shorter-phrase ambitions, your aim should be a lower degree of risk along with a high volume of safety. You don’t want to shed any money when you need to offer an investment to Get the cash. And that’s the big strategy behind liquidity: The opportunity to Get the dollars without possibly hold off or loss.

Move six: Discover The prices of Investing Commissions and charges Aside from standing and healthy with your investment strategy and ambitions, broker service fees are the most important consideration if you're picking a brokerage firm, which comes in the subsequent action.

Index funds are usually purchased at sector shut, where by ETFs may be purchased Reside during the day. Index funds and ETFs are passively managed plus they feature extremely lower service fees, earning them a terrific way to invest and make money everyday.

Equity index funds can hold hundreds or maybe Many person stocks, as they purpose to imitate the functionality of a certain index.

Fidelity was voted by far the most trusted wealth management firm for 2023 through the visitors of Investor's Organization Day-to-day

A focused Fidelity advisor can function with you to help you create a plan for your total financial image, collaborating with you on modifications as your preferences evolve.

The key difference between a money market place account and also a high investments online produce savings account or CD is that you are generally equipped to write checks out of your account. It is incredibly straightforward to open an account and get rolling making money each day.

Before you invest a penny, It is really a smart idea to make sure you don't have any high-interest debts including credit playing cards, personal loans, or pupil loans.

Property contributed might ira investment tax credit be offered to get a taxable gain or decline at any time. There are no guarantees as towards the effectiveness in the tax-intelligent investing procedures used in serving to cut back or lower a consumer's All round tax liabilities, or as to the tax outcomes that could be created by a offered transaction. seven. "Managed portfolio" or "managed account" seek advice from the discretionary investment management services accessible as a result of one or more Portfolio Advisory Services accounts for a payment to investors who enroll in Fidelity® Wealth Services. Tax-sensitive Portfolio Advisory Services accounts are managed utilizing tax-clever investing methods in the discretion of Strategic Advisers. Begin to see the Fidelity Wealth Services Plan Fundamentals (PDF) for method information or discuss with a Fidelity advisor.

The most significant variation is that ETFs trade on significant stock exchanges, and you can invest in shares Anytime the stock market is open. Mutual funds only price their shares once per day and are not nearly as liquid.

Mutual funds are much like ETFs. They pool investors' money and utilize it to build up a portfolio of stocks or other investments.

When you are debating starting a company, you will need to craft a prepare and strategy to make certain that it launches and grows.

Luke Perry Then & Now!

Luke Perry Then & Now! Dylan and Cole Sprouse Then & Now!

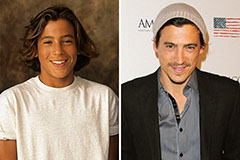

Dylan and Cole Sprouse Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Jennifer Love Hewitt Then & Now!

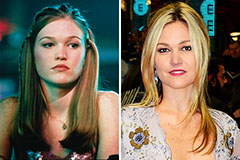

Jennifer Love Hewitt Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now!